Table of Contents

- TLT Stock Price and Chart — TradingView

- TLT -20+ YEARS TREASURY BOND ETF- UPDATE | Charlie Supph

- Tlt Ishares 20 Year Treasury Bond Etf Price Wealthfront Security – AZ Trans

- TLT Stock Price and Chart — TradingView

- TLT: I Was Wrong (NASDAQ:TLT) | Seeking Alpha

- Reflecting on My Cybersecurity Internship at TLT - Tomorrow's Leaders Today

- TLT Stock Price and Chart — TradingView

- The 20 year Treasury Bond versus the TLT ETF - Which is better for ...

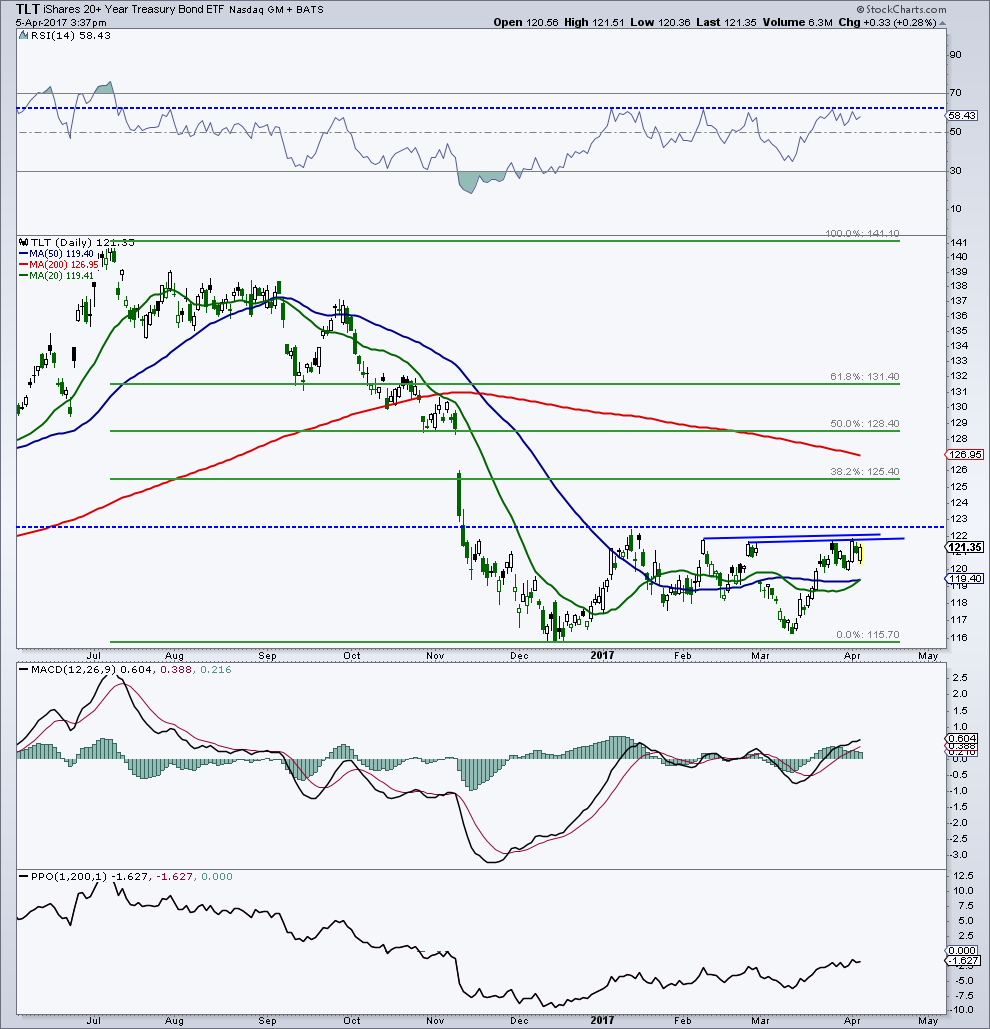

- Treasury Bonds Update (TLT): Bulls Eyeing Key Resistance - See It Market

- TLT Stock Price and Chart — TradingView

What is TLT ETF?

TLT ETF Stock Price

/https:%2F%2Fblogs-images.forbes.com%2Fmarcgerstein%2Ffiles%2F2016%2F07%2Ftlt.jpg)

Key Features of TLT ETF

Here are some key features of the TLT ETF that investors should be aware of: Tracks the ICE U.S. Treasury 20+ Year Bond Index: The TLT ETF provides exposure to a diversified portfolio of long-term Treasury bonds, allowing investors to benefit from the potential price appreciation and income generation of these securities. Low Expense Ratio: The TLT ETF has an expense ratio of 0.15%, making it a cost-effective option for investors. High Trading Volume: The TLT ETF has an average daily trading volume of over $1 billion, providing investors with liquidity and flexibility. Dividend Yield: The TLT ETF has a dividend yield of around 2.5%, providing investors with a regular income stream.

Investment Strategies for TLT ETF

The TLT ETF can be used in a variety of investment strategies, including: Income Generation: The TLT ETF can provide investors with a regular income stream through its dividend payments. Portfolio Diversification: The TLT ETF can be used to diversify a portfolio by adding exposure to long-term Treasury bonds. Hedging: The TLT ETF can be used as a hedge against rising interest rates, as its price tends to increase when interest rates fall. In conclusion, the TLT ETF is a popular inverse ETF that provides investors with exposure to long-term Treasury bonds. With its low expense ratio, high trading volume, and dividend yield, the TLT ETF can be a valuable addition to a diversified investment portfolio. However, it's essential to keep in mind that the TLT ETF stock price can fluctuate rapidly due to changes in interest rates and other market conditions. As with any investment, it's crucial to do your research and consult with a financial advisor before making any investment decisions.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of any organization or individual.