Table of Contents

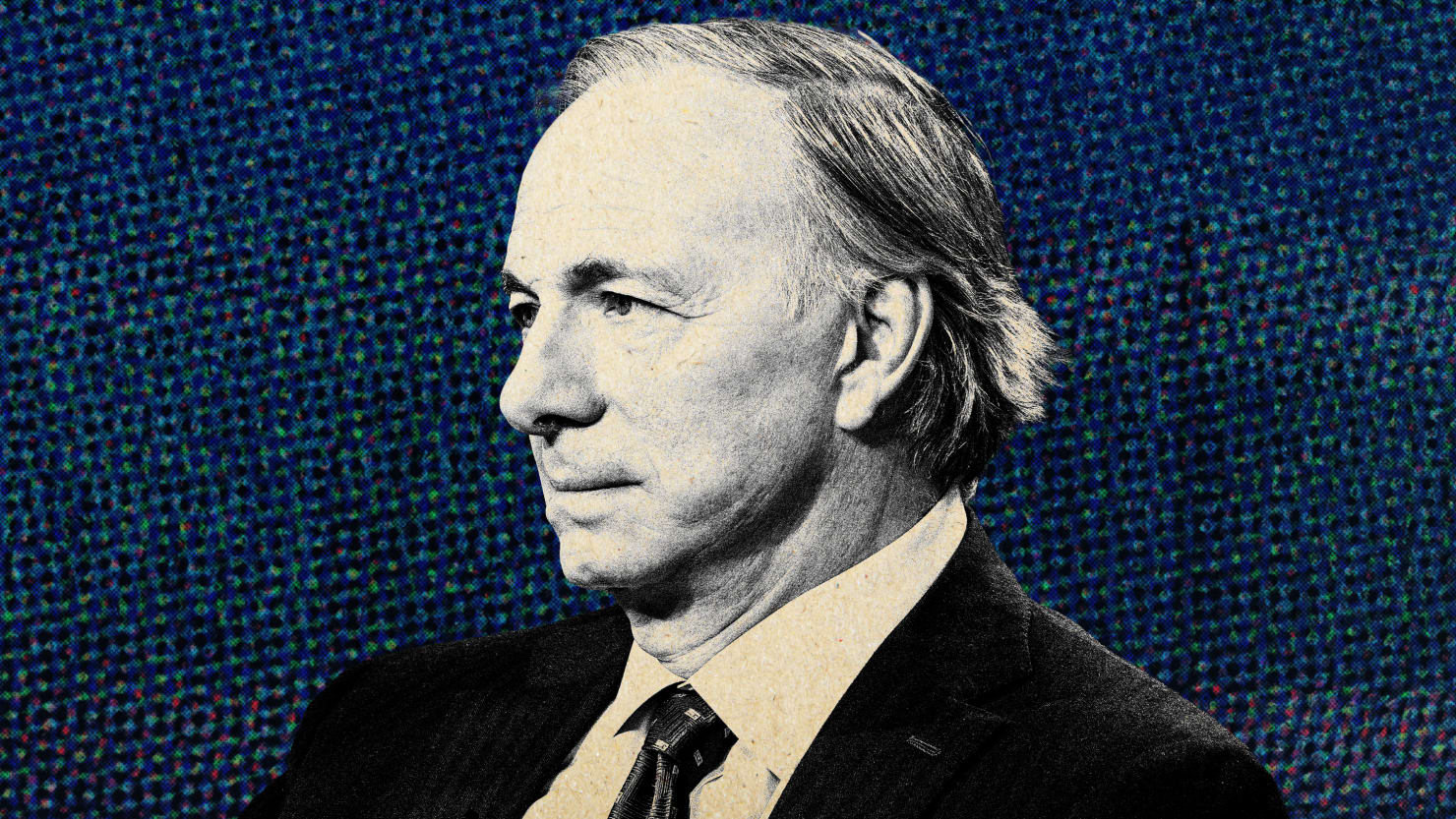

- Ray Dalio et les principes du succès financier - ISF-systext

- Ray Dalio's Dollar Warning Suggests Gold Price Will Surge

- Ray Dalio on populism - Business Insider

- Inside the ‘The Fund,’ the Tell-All Billionaire Ray Dalio Tried to Stop

- Ray Dalio: China's ingenuity can help it overcome economic hurdles - CGTN

- Current Ray Dalio Portfolio 2023: Bridgewater Associates Holdings - New ...

- The Fund: Ray Dalio, Bridgewater Associates, and the Unraveling of a ...

- Ray Dalio’s Master Plan to Make His Hedge Fund Cult Immortal | Vanity Fair

- Ray Dalio ha empezado a invertir en submarinos para ricos una semanas ...

- Bridgewater's Ray Dalio on his succession plan, 'radically transparent ...

Understanding Ray Dalio's Prediction

Dalio's concerns are not unfounded. The global economy is indeed facing significant challenges, from the ongoing trade war between the US and China to the rising debt levels in many countries. The yield curve, which is often seen as a reliable indicator of a recession, has also been flashing warning signs. All these factors combined have led Dalio to conclude that a recession is not only possible but likely.

Implications for Investors

Preparing for the Worst

While no one can predict with certainty when or if a recession will occur, it's always better to be prepared. By taking a proactive approach to managing your investments and finances, you can minimize the impact of a potential downturn. Here are some additional tips to help you prepare: Stay informed: Stay up-to-date with the latest economic news and trends to make informed investment decisions. Review your budget: Take a close look at your budget and make adjustments to reduce unnecessary expenses. Consider alternative investments: Look into alternative investments, such as gold or real estate, which can provide a hedge against inflation and market volatility.In conclusion, Ray Dalio's warning of a likely recession should not be taken lightly. By understanding the signs of a potential downturn and taking steps to protect your portfolio, you can minimize the impact of a recession and come out stronger on the other side. Remember to stay informed, diversify your investments, and prepare for the worst to ensure your financial well-being.